Capital for Teenagers: Online Money-Making Tips

- Capital for Teenagers: Online Money-Making Tips

- Significance of Finance

- Comprehending Capital

- Income Sources

- Sorts Of Expenditures

- Online Money-Making Opportunities for Teenagers

- Freelancing

- Marketing Products Online

- Structure a Lasting Revenue Stream

- Spending

- Easy Revenue Concepts

- Taking Care Of and Expanding Your Cash

- Budgeting Tips

- Conserving Methods

Significance of Finance

In today’s hectic globe, where pleasure principle commonly takes priority over long-lasting preparation, understanding the art of finance has actually never ever been even more important. For teenagers and young people entering economic self-reliance, comprehending exactly how to deal with cash efficiently can lead the way to a safe future. Lots of youths discover themselves with brand-new earnings streams– from part-time tasks to allocations– yet do not have the expertise on exactly how to maximize what they have. This commonly causes spontaneous costs, stress, and also economic remorse. Developing excellent finance techniques at an early stage can transform the trend. Think about the situation of Alex, a senior high school pupil that tackled a summer season work. At first, he was enjoyed have his very own cash to invest in video games and getaways with good friends. Nonetheless, by the end of the summer season, he recognized he had little cost savings left and really felt not really prepared for the approaching academic year expenditures. This mind-blowing experience encouraged Alex to find out more concerning budgeting and conserving, leading him to check out finance sources. Below are a number of crucial reasons understanding finance is necessary:

- Monetary Self-reliance: Having control over one’s financial resources enables higher individual flexibility and selections in life.

- Emergency Situation Readiness: Finance makes sure that people can deal with unforeseen expenditures without a substantial loss of security.

- Objective Success: Whether it’s conserving for an automobile, university, or a significant acquisition, reliable finance prepares for attaining these objectives.

- Decreased Anxiety: Handling cash well substantially decreases economic stress and anxiety, enabling people to concentrate a lot more on their researches and much less on financial concerns.

Establishing solid finance abilities is not practically conserving; it has to do with growing a way of thinking that focuses on economic health and wellness, guaranteeing that a person’s desires continue to be available. As we dive deeper right into comprehending capital and checking out on the internet lucrative possibilities, the concepts of reliable finance will certainly act as the structure for all future economic choices.

Comprehending Capital

Income Sources

When young people comprehend the relevance of finance, the following crucial action is comprehending capital– an important idea that includes monitoring earnings and expenses. The structure of reliable capital administration begins with recognizing numerous incomes. For teenagers, earnings might originate from a number of methods:

- Part-Time Jobs: Lots of young adults occupy part-time tasks in retail, junk food, or tutoring, gaining them a constant stream of cash.

- Allocations: For some, a regular or regular monthly allocation can act as a reputable resource of earnings from moms and dads.

- Freelancing: With the surge of the job economic climate, several youths use their abilities– like visuals layout, composing, or programs– via freelancing systems.

- Marketing Product Online: Websites like Etsy or ebay.com use possibilities to transform leisure activities such as crafts or second hand purchasing right into revenue.

Comprehending these resources aids people assembled an extra thorough sight of their economic landscape.

Sorts Of Expenditures

Similarly vital is recognizing the kinds of expenditures one sustains. Understanding where the cash goes is crucial to preserving a favorable capital. Expenditures can normally be classified right into 2 kinds:

- Fixed Expenditures: These are normal, foreseeable prices that continue to be reasonably continuous, such as:

- Month-to-month memberships (Netflix, Spotify)

- Tuition charges

- Insurance policy settlements

- Variable Expenditures: These can change month to month and require even more focus, as an example:

- Food and eating in restaurants

- Enjoyment and leisure activities

- Looking for garments or electronic devices

Take Into Consideration Jamie, a college-bound teen taking care of some new-found self-reliance. While Jamie functioned part-time and conserved vigilantly, he quickly recognized that his spontaneous late-night takeout orders substantially affected his regular monthly spending plan. By tracking his incomes together with his variable expenditures, Jamie had the ability to make enlightened choices to cut down on unneeded costs. By establishing a clear understanding of earnings and expenditures, youths can produce a well balanced capital that sustains their economic objectives. As we proceed checking out on the internet lucrative possibilities and methods for lasting earnings, a clear understanding of capital will certainly verify important in the trip towards economic health and wellness.

Online Money-Making Opportunities for Teenagers

Freelancing

With a strong understanding of capital, teenagers are currently prepared to check out numerous on the internet lucrative possibilities offered at their fingertips. Among one of the most adaptable and gratifying choices is freelancing. The appeal of freelancing depend on the capacity to use abilities and solutions on a task basis, enabling teenagers to handle their time efficiently while still concentrating on institution or various other dedications. Systems like Fiverr, Upwork, and Consultant make it very easy to get in touch with possible customers. Below are a couple of prominent freelancing choices for teenagers:

- Graphic Layout: If a teenager has a propensity for layout, they can produce logo designs, social networks graphics, and advertising products for services.

- Creating and Blog Writing: For those with a method with words, composing posts, post, or perhaps editing and enhancing solutions can supply a useful earnings stream.

- Tutoring: Teenagers can utilize their expertise in topics they succeed at, using on the internet tutoring to more youthful trainees.

- Social Media Site Administration: As electronic locals, several teenagers are skilled in social networks systems. They can aid services construct their on the internet visibility.

Take Into Consideration Sophie, an imaginative teen that uncovered her love for visuals layout. By showcasing her profile online and handling freelance jobs, she not just gained additional money however additionally got real-world experience that would certainly profit her resumé down the line.

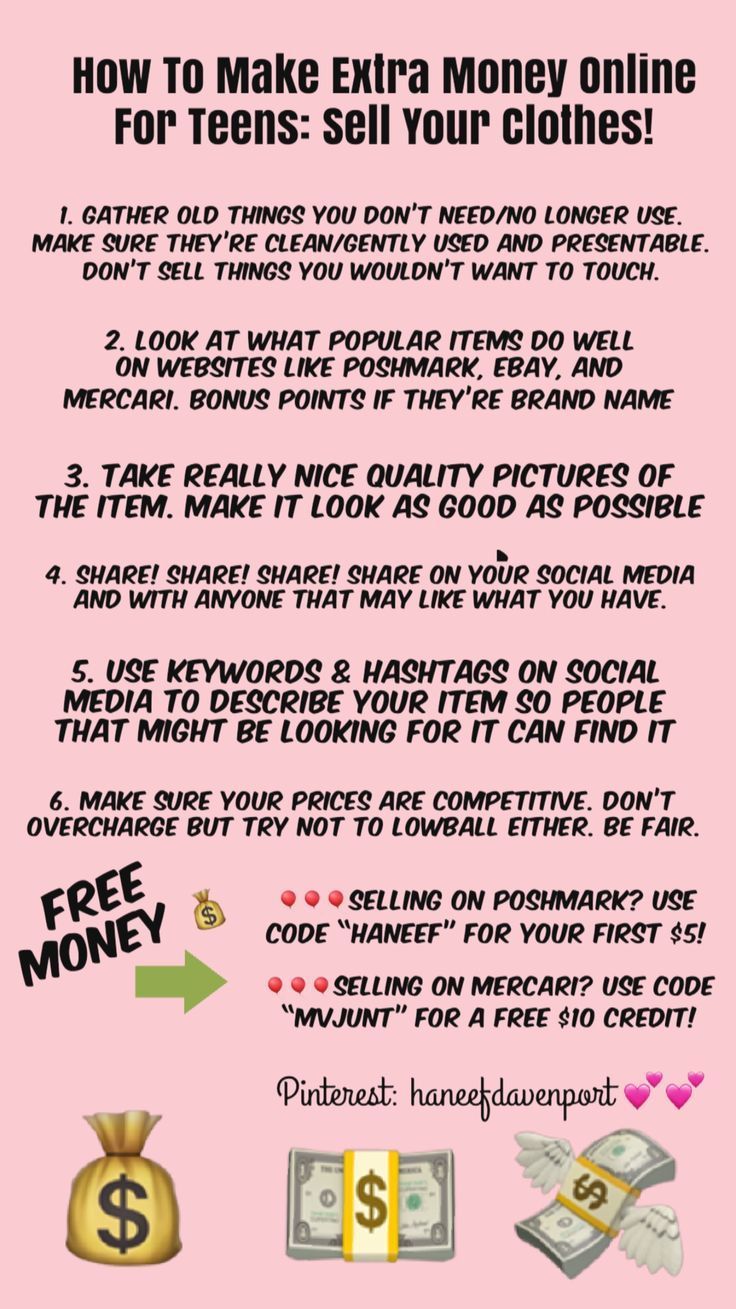

Marketing Products Online

An additional profitable opportunity for teenagers looking for to make money is offering items online. With systems like Etsy, ebay.com, and Poshmark, teenagers can transform their leisure activities right into successful endeavors. Below’s exactly how to get going:

- Crafts and Handmade Product: If a teenager appreciates crafting, they can produce hand-made fashion jewelry, candle lights, or crafts to offer online.

- Second Hand Purchasing: Searching for special things at second hand shops and marketing them online can be both enjoyable and successful. Lots of teenagers appreciate curating classic garments or antiques.

- Digital Products: From coordinators to electronic art, offering downloadable items can be a reasonable means to gain easy earnings.

Take Leo, as an example, that began by offering custom-made Tees on Etsy. As he got fans and sales, he had the ability to scale his procedure, adding meaningfully to his cost savings. By diving right into on the internet freelance job or marketing items, teenagers can both boost their economic proficiency and gain important abilities that will certainly offer them well in the future. As they start this trip, they are developing a lasting earnings stream while developing their business spirit. Next off, we’ll check out methods to establish these possibilities right into an extra continual earnings.

Structure a Lasting Revenue Stream

Spending

Having actually checked out on the internet lucrative possibilities, it’s important for teenagers to believe past prompt profits and begin developing a lasting earnings stream. Among the most intelligent methods to do this is via investing. While the concept of spending could appear intimidating in the beginning, it can be exceptionally gratifying over time. Spending is not simply for grownups taking care of huge profiles; teenagers can additionally start tiny and expand their financial investments with time. Below are some easily accessible financial investment choices for young financiers:

- Supplies: With the surge of easy to use investing applications like Robinhood or Acorns, teenagers can begin acquiring fractional shares of firms they count on.

- Index Funds and ETFs: These permit financiers to expand their profiles, with much less threat by merging cash right into numerous supplies or bonds simultaneously.

- Financial Savings Accounts or CDs: While not typical financial investments, they supply a refuge to expand cash with passion, particularly for those reluctant to study a lot more unpredictable choices.

Take Mia, as an example, that began purchasing supplies as a method to expand her cost savings for university. She started with simply $100, looking into firms and seeing exactly how her cash expanded over a couple of months. Informing herself concerning clever investing not just enhanced her self-confidence however additionally placed her when traveling to economic self-reliance.

Easy Revenue Concepts

Along with typical investing, checking out easy earnings concepts can be a reliable means to construct wide range. Easy earnings is cash gained with little energetic participation, permitting even more leisure time without compromising profits. Below are some prominent easy earnings concepts for teenagers:

- Developing Digital Products: When developed, electronic books, on the internet training courses, or printables can be offered repetitively without much extra initiative.

- Associate Advertising: By advertising items on social networks or blog sites, teenagers can gain payments for sale made via their recommendation web links.

- Purchasing Property Crowdfunding: Systems like Fundrise permit customers to buy property with very little quantities and gain rental earnings without possessing residential properties straight.

Visualize Alex, that, after conserving for a couple of months, chose to compose an electronic book concerning his experience with independent visuals layout. When released, each sale remained to produce earnings with little upkeep. This technique permitted him to generate income while he concentrated on various other jobs. By welcoming both spending and easy earnings concepts, teenagers can grow lasting earnings streams that sustain their economic objectives and desires for the future. This alternative technique to finance will inevitably supply higher economic security and self-reliance. Next off, we’ll look into handling and expanding this cash sensibly.

Taking Care Of and Expanding Your Cash

Budgeting Tips

With a strong structure in gaining and spending, the following important action for teenagers is taking care of and expanding their cash efficiently. Budgeting is the keystone of economic administration– it aids teenagers recognize where their cash goes and guarantees they can assign sources effectively. Below are some useful budgeting suggestions:

- Track Revenue and Expenditures: Beginning by logging all incomes, incorporated with regular monthly expenditures. Applications like Mint or YNAB (You Required A Budget plan) can make this procedure basic and aesthetically enticing.

- Establish Clear Objectives: Whether it’s conserving for a brand-new phone or university tuition, establishing details economic objectives aids encourage and offers instructions.

- 50/30/20 Guideline: A prominent budgeting technique advises costs 50% on requirements, 30% on desires, and conserving 20%. This structure aids maintain costs in check while additionally concentrating on cost savings.

- Testimonial and Change Month-to-month: Routinely take another look at the spending plan to make changes as essential. If unforeseen expenditures occur, it’s important to remain adaptable.

Take Chloe, as an example, that utilized a straightforward spread sheet to maintain tabs on her earnings from babysitting and her regular monthly expenditures. By integrating the 50/30/20 guideline, she had the ability to conserve for both enjoyable getaways and her university fund without really feeling bewildered.

Conserving Methods

When there’s a clear spending plan in position, developing reliable conserving methods ends up being simpler and a lot more organized. Having a financial savings strategy safeguards economic security and plans for future expenditures. Below are some tested conserving methods:

- Automate Financial Savings: Establishing automated transfers from examining to cost savings can motivate conserving by treating it as a persisting cost.

- Develop a Reserve: Goal to conserve at the very least 3 to 6 months’ well worth of living expenditures to defend against unforeseen economic missteps.

- Use High-Interest Financial Savings Accounts: Search for on the internet financial institutions that use greater rates of interest, enabling cost savings to expand much faster.

- Make The Most Of Discount Rates and Bargains: Usage pupil price cuts or cashback applications when going shopping to conserve cash without changing costs practices substantially.

Matt, an additional teenager, chose to automate his cost savings by moving a repaired quantity from his income right into a high-interest interest-bearing account on a monthly basis. This method aided him construct a reserve while still taking care of to appreciate his preferred tasks. By mixing smart budgeting with reliable conserving methods, teenagers can not just handle their gained earnings however additionally produce an economic padding for the future. Complying with these actions will certainly advertise a feeling of economic tranquility, enabling young people to concentrate on their researches, enthusiasms, and objectives without the continuous fear of economic pressures. Inevitably, these techniques prepared for a flourishing and steady economic future.